DoJiggy Proudly Supports Canadian Organizations

Fundraising In Canada Has Never Been So Fun and Easy

Get Started for Free and Raise More Online Than Ever Before

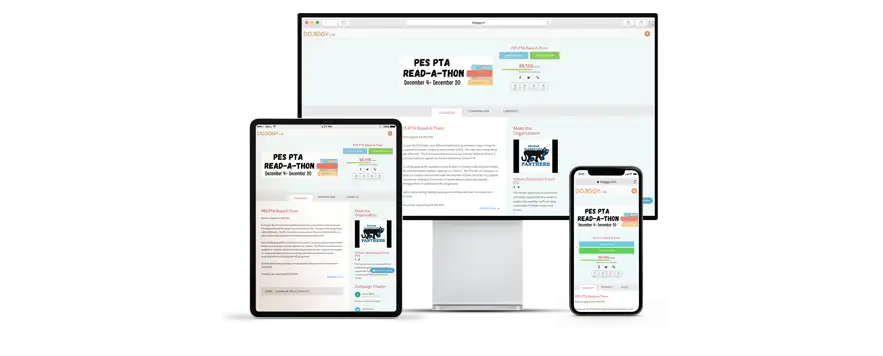

DoJiggy is a leading provider of affordable, online event management and virtual fundraising solutions for nonprofits and charities, schools and Parent Advisory Councils (PACs), and community organizations in Canada.

Here at DoJiggy, we love our neighbors to the north. We are often asked if our fundraising platform works for Canadian organizations, and the simple answer is yes! We have been working with Canadian groups since 2003 and have already helped hundreds of organizations in Canada run successful fundraising events with our software platform.

Here are the ways that we work for organizations fundraising in Canada.

Great Fundraising Software

DoJiggy provides a complete suite for online fundraising in Canada. Our easy-to-use and affordable software solutions enable customers to increase efficiency in planning fundraising events, helping them save time and money. Plus, the platform provides full support for Canadian currency, addresses, and phones.

Our cloud-based software includes secure registration and donation management tools for:

- Run/Walk/Ride and peer-to-peer crowdfunding campaigns

- Charity golf tournaments

- Online fundraising auctions

- Event registration for nonprofit fundraising events

- Charity raffles

- Online eCommerce stores

- Donation software for one-time or recurring donations

Payment Processing for Canadian Organizations

One important decision you’ll need to make is choosing your payment processing partner. Rest assured that we have solutions for Canadian clients. You will accept donations in CAD with no foreign transaction or currency conversion fees.

Our fundraising platform integrates with Stripe for CAD processing. Stripe provides a discount for Canadian registered charities, flat-rate credit card processing fees, and no set-up or monthly fees.

Cheques can also be accepted with no fees.

Canada Revenue Agency Official Tax Receipts

Canadian charities can provide Canada Revenue Agency (CRA) approved electronic receipts to donors. These are auto-generated with each approved donation when enabled. Organizations can customize the receipts with your organization’s branding and information.

According to the Canadian Revenue Agency (CRA), tax receipts can only be sent for donations where the donor did not receive goods or services in exchange. The system will automatically detect the kind of donation the donor made on your fundraiser and send them a tax receipt accordingly.

Examples of CRA eligible donations

- Donations on a crowdfunding campaign that doesn’t offer perks

- One-time or recurring donations on a donation page

- Per-unit and flat amount donations on an Athon fundraiser

- Direct donations (without receiving goods or services in exchange) on other campaign types

Examples of CRA ineligible donations

- Raffle entry purchases

- Item purchases on a sale fundraiser

- Bids on auction items

- Ticket purchases on an event campaign

Limited Support for French Language

Your website pages and customizable emails can be created bilingually or in French. Many Canadian organizations create their content in both English and French. Please note that registration forms, receipts, and all company support materials are only available in English at this time.

Crowdfunding in Canada

Charity crowdfunding campaigns are big in Canada, and for a good reason – they work! If your organization is looking for an innovative way to fundraise for your mission while engaging your supporters, crowdfunding may be just the solution you’ve been looking for.

Crowdfunding is the practice of funding a project or initiative by raising money from a large number of people. Crowdfunding for nonprofits allows individuals to reach out to their network to raise funds while acting on behalf of an organization they feel passionate about. Crowdfunding may also be referred to as peer-to-peer fundraising because of the way in which people ask their peers for financial support for a charity’s mission.

We Support All Kinds of Canadian Peer to Peer and Charity Crowdfunding Campaigns

Car Wash-a-thons

Community Serve-a-thons

Surfing Events

Meditation Sit-a-thons

Paddle-a-thons

Clay Shoots

Climb-a-thons

Board of Directors Fundraising Events

Chili Cook-offs

Canadian Client References

Get Started Today with Affordable, Easy-to-Use Charity Software for Canadian Fundraising Campaigns