Nonprofit organizations play a crucial role in addressing social, educational, and cultural needs in our society. They come in various forms, each with its own unique purpose and tax-exempt status. Understanding the different types of 501c nonprofit organizations and how they fundraise can help you choose the right structure for your mission and maximize your fundraising efforts. Read on to learn more about the differences and similarities between the most common nonprofit groups, such as 501c3, 501c4s, and 501c6s.

What We’ll Learn

- What Is a 501c Organization?

- What Are the Different Types of Nonprofit Organizations?

- 501(c)(3): Charitable, Religious or Educational Organizations

- 501(c)(4): Community Social Welfare Organizations

- 501(c)(6): Business Leagues

- What’s the Difference Between a 501c3 and 501c4 Organization?

- Fundraising with DoJiggy

- Which Organizations Can Legally Run Charity Raffles?

- Conclusion

What Is a 501c Organization?

A 501c nonprofit organization is a legal entity organized and operated for a collective, public, or social benefit rather than to generate profits for owners or investors. There are about 29 different types of these organizations, and they are named as such: 501c1, 501c2, 501c3, etc. These organizations must reinvest any surplus revenue to further their mission rather than distribute it as profit or dividends to owners, as businesses do.

Under Section 501(c) of the Internal Revenue Code, nonprofits are exempt from some federal income taxes, provided they meet certain requirements.

What Are the Different Types of Nonprofit Organizations?

There are over 30 different types of 501c organizations. Your choice of nonprofit status and fundraising strategy can significantly impact your organization’s ability to achieve its mission. By understanding the different types of 501c organizations and leveraging effective fundraising tools, you can ensure your nonprofit thrives and makes a meaningful difference in the community.

We’ll cover the most common 501c organizations below and how they fundraise. If you want to review the full listing of these groups, Forbes has a great article for that.

501(c)(3): Charitable, Religious or Educational Organizations

501(c)(3) organizations are the most common type of nonprofit entity. They must operate exclusively for exempt purposes as set forth in section 501(c)(3) of the Internal Revenue Code, including charitable, religious, educational, scientific, and literary purposes. They are restricted in their lobbying activities and are prohibited from political campaign activities.

- Examples: schools, churches, animal shelters

- Fundraising::

- Donations: The primary source of funding, often encouraged by the tax-deductible nature of contributions.

- Grants: Eligibility for government and private foundation grants, which can provide substantial funding for projects and operational costs.

- Events: Fundraising events like galas, walk-a-thon fundraisers, and auctions can help raise significant funds while engaging the community.

- Merchandise Sales: Selling branded items or products related to their mission can be a lucrative fundraising method.

- Membership Fees: For organizations that offer memberships, these fees can provide a steady stream of revenue.

Check out our step-by-step instructions on how to start a 501(c)(3) nonprofit organization.

501(c)(4): Community Social Welfare Organizations

A 501(c)(4) organization is a nonprofit that focuses on promoting social welfare. Unlike 501(c)(3) organizations, they can engage in some political activities, provided these activities are not their primary function. While donations to 501(c)(4) organizations are not tax-deductible, these nonprofits can raise funds through membership fees, events, and political lobbying efforts.

This level of involvement can raise questions like “Is a 501c4 organization a nonprofit?” but rest assured, 501(c)(4) organizations are legal nonprofit entities when IRS guidelines are followed.

- Examples: Civic leagues and advocacy groups.

- Fundraising:

- Membership Fees: These can provide a steady source of income and help cover operational costs.

- Events: Hosting fundraising events, such as dinners, auctions, or sports events, can attract donations from individuals and businesses.

- Political Lobbying: Engaging in lobbying efforts and seeking donations from individuals and groups who support their political and social goals.

- Merchandise Sales: Selling branded merchandise can also be a viable way to raise funds while promoting the organization’s mission.

- Grants: Although more limited compared to 501(c)(3) organizations, 501(c)(4) groups can still apply for certain grants that do not require tax-exempt status.

501(c)(6): Business Leagues

501(c)(6) organizations are business leagues, chambers of commerce, and similar entities that are not organized for profit, and no part of their net earnings accrues to the benefit of any private shareholder or individual. These organizations promote members’ common business interests and improve business conditions in one or more lines of business.

- Examples: Chambers of Commerce, trade associations, and professional football leagues.

- Fundraising:

- Membership Dues: Regular fees collected from members to fund the organization’s activities and services.

- Sponsorships: Financial support from businesses and individuals in exchange for promotional opportunities and partnership benefits.

- Events: Hosting conferences, trade shows, networking events, and training sessions to generate revenue while providing value to members.

What’s the Difference Between a 501c3 and 501c4 Organization?

The main difference between 501(c)(3) and 501(c)(4) organizations lies in their purpose and the tax benefits they offer. 501(c)(3) organizations are primarily charitable and allow donors to deduct contributions from their taxes. In contrast, 501(c)(4) organizations focus on social welfare and can engage in more political activities, but donations to them are not tax-deductible.

Fundraising with DoJiggy

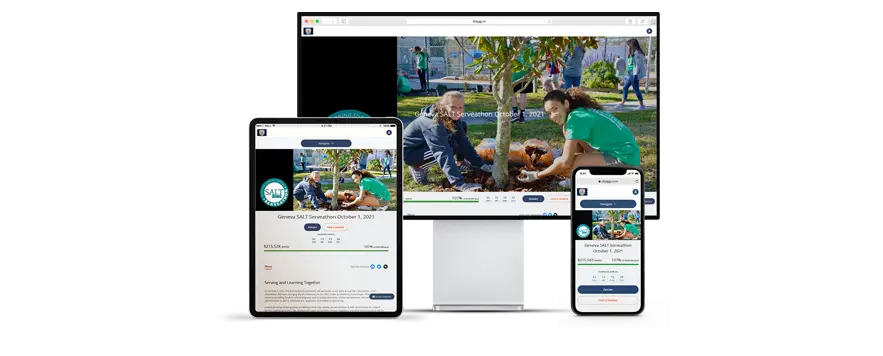

All types of charitable organizations need to raise funds, and DoJiggy supports them all. Whether you are hosting a charity run, organizing a gala, or launching an online crowdfunding campaign, DoJiggy provides the tools and resources to make your fundraising efforts successful.

Which Organizations Can Legally Run Charity Raffles?

Fundraising raffles are considered a form of gaming and are strictly regulated as such. Adherence to specific raffle rules can impact 501 (c) organizations’ tax-exempt status, making compliance a top priority.

DoJiggy allows all types of 501(c) organizations to host raffles on our platform as long as they are not located in a state where raffles are prohibited. You can check your organization’s raffle eligibility by state here.

It is ultimately up to the organization to ensure that any raffle they create complies with all raffle laws in their area. Organizations should look closely at the strictly regulated guidelines for fundraising raffles. Charity sweepstakes are less-regulated alternatives to raffles and can effectively raise funds without navigating complex legal requirements.

Conclusion

With dozens of tax-exempt 501 statuses available, choosing the right nonprofit type can be difficult. When deciding the best fit for your organization, consider your mission, who is organizing the entity, and who the nonprofit will serve. Understanding the different types of 501c nonprofit organizations and how they fundraise can help you make informed decisions and effectively support your cause.

![How to Start A Nonprofit 501(c)3 Org. [10 Step Guide] How to Start A Nonprofit 501(c)3 Org. [10 Step Guide]](https://www.dojiggy.com/files/sites/164/2019/03/How-to-Start-A-Nonprofit-501c3-Org-10-Step-Guide-423x282.webp)