Conducting a raffle is a fantastic way to fundraise for your organization. However, Canada’s legal landscape for raffles is as diverse as its provinces and territories. Similar to our comprehensive guide on U.S. Raffle Laws by State, this article aims to shed light on the intricacies of Canadian raffle regulations.

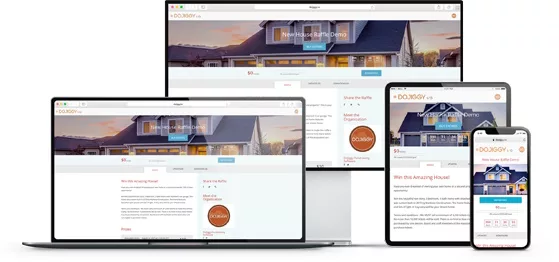

At DoJiggy, we understand the importance of compliance and have designed our software to support your fundraising efforts across all Canadian provinces without limitations. It’s crucial for organizations to stay informed and adhere to their specific provincial laws to ensure a successful and legal raffle campaign.

Overview of Canadian Raffle Regulations

Canada’s approach to raffle regulations varies significantly from province to province. These laws govern who can hold a raffle, the types of raffles permitted, and the necessary steps to legally conduct a raffle. Understanding these regulations is the first step in planning your fundraising strategy.

While our donor-friendly raffle platform offers comprehensive solutions for managing raffle fundraisers, the responsibility of complying with local laws remains with organizations. Our platform facilitates the process, but the legal groundwork is in your hands.

Provincial and Territorial Raffle Laws

The Canadian landscape of raffle regulations features a mosaic of rules and requirements. Here’s a glance at what organizations need to consider in various jurisdictions:

| Province/Territory | Eligibility for Conducting Raffles | Types of Raffles Allowed | Licensing Requirements | Notable Restrictions/Reporting Obligations |

|---|---|---|---|---|

| Alberta | Non-profit/charitable organizations | Standard, 50/50, Bingo | Yes, varies by prize value and ticket sales | Must report on use of proceeds, strict advertising rules |

| British Columbia | Non-profit/charitable organizations | Standard, 50/50, Online | Yes, based on prize value | Must adhere to specific rules on ticket sales and prize awarding | Manitoba | Non-profit/charitable organizations | Standard, 50/50, Sports Draft | Yes, for raffles exceeding certain thresholds | Periodic financial reporting required | New Brunswick | Non-profit/charitable organizations | Standard, 50/50 | Yes, depending on prize value | Restrictions on prize types and advertising | Newfoundland and Labrador | Non-profit/charitable organizations | Standard, 50/50, Online | Yes, for most raffles | Approval needed for prizes over a certain value | Northwest Territories | Non-profit/charitable organizations | Standard, 50/50, Chase the Ace | Yes, depending on the event scale | Specific rules on ticket sales and prize distribution | Nova Scotia | Non-profit/charitable organizations | Standard, 50/50 | Yes, varies by prize value | Annual reporting may be required | Nunavut | Non-profit/charitable organizations | Standard, 50/50 | License often required, specific conditions apply | Limited information; check with local authorities | Ontario | Non-profit/charitable organizations | Standard, 50/50, Break Open Tickets | Yes, stringent requirements | Detailed financial reporting and use of proceeds restrictions | Prince Edward Island | Non-profit/charitable organizations | Standard, 50/50 | Yes, depending on the raffle size | Must comply with advertising and prize awarding rules | Quebec | Non-profit/charitable organizations | Standard, 50/50, Online | Yes, particularly strict for online raffles | French language requirements for tickets and advertising | Saskatchewan | Non-profit/charitable organizations | Standard, 50/50, Wheel of Fortune | Yes, varies by event size | Annual reporting and specific rules on ticket sales | Yukon | Non-profit/charitable organizations | Standard, 50/50, Casino-style | Yes, depending on prize value and ticket sales | Regulations on prize awarding and financial reporting |

For the most accurate and detailed information on raffle laws and regulations in each Canadian province and territory, it’s best to consult the official government or regulatory body websites. Below is a list of URLs where you can find information specific to conducting raffles in each jurisdiction:

- Alberta: Alberta Gaming, Liquor and Cannabis (AGLC)

- British Columbia: Gaming Policy and Enforcement Branch

- Manitoba: Liquor, Gaming and Cannabis Authority of Manitoba

- New Brunswick: New Brunswick Department of Public Safety

- Newfoundland and Labrador: Service NL

- Northwest Territories: Department of Municipal and Community Affairs

- Nova Scotia: Alcohol, Gaming, Fuel and Tobacco Division of Service Nova Scotia

- Nunavut: Nunavut Department of Community and Government Services

- Ontario: Alcohol and Gaming Commission of Ontario (AGCO)

- Prince Edward Island: PEI Consumer Services

- Quebec: Régie des alcools, des courses et des jeux (RACJ)

- Saskatchewan: Saskatchewan Liquor and Gaming Authority (SLGA)

- Yukon: Professional Licensing & Regulatory Affairs

Navigating the complexities of raffle laws necessitates a comprehensive and proactive strategy to ensure full compliance. Below are the best practices to guide organizations and individuals in conducting raffles legally and successfully in Canada.

In-Depth Legal Research

- Understand Local Regulations: Raffle laws vary significantly across different jurisdictions. Diving deep into the specific legal requirements governing raffles in your province or territory is imperative. This includes understanding the permits needed, age restrictions for participants, and whether online ticket sales are permitted.

- Consult with Legal Experts: Given the complexity of gambling laws, consulting with legal professionals specializing in this area can clarify and ensure that your raffle does not inadvertently violate local laws.

Record Keeping

- Document Everything: From the moment you plan your raffle, keep meticulous records of every aspect of the event. This includes detailed accounts of ticket sales (both online and offline), the total number of tickets sold, the names of prize winners, and the value of prizes awarded.

- Financial Transparency: Ensure that all financial transactions related to the raffle are transparent and accurately recorded. This includes the cost of organizing the raffle, the amount raised, and how the funds will be used. Accurate financial reporting is often required by law and is critical for maintaining the trust of participants and the general public.

Using an Online Raffle Platform

- Choosing the Right Platform: Technology can significantly ease the management of raffle fundraisers. Platforms like DoJiggy provide comprehensive solutions to help your group adhere to local regulations. These platforms can handle various aspects of the raffle, from ticket sales and payment processing to randomly selecting winners.

- Benefits of Using Software: Utilizing a reliable software platform can help automate the compliance process, reduce the risk of human error, and provide a secure and transparent system for participants. Features like real-time ticket sales tracking, automated winner notifications, and detailed reporting can streamline operations and ensure compliance.

Continuous Compliance and Updating Procedures

- Stay Informed on Legal Changes: Laws and regulations governing raffles can change. Regularly update your knowledge and procedures to reflect current laws. This might involve revising your raffle plans, updating software settings, or consulting with legal experts for new developments.

- Feedback Loop: After conducting a raffle, evaluate the process to identify any compliance gaps or operational inefficiencies. Use this feedback to improve future raffles, ensuring they are not only compliant but also successful in achieving their fundraising goals.

Conclusion

Raffle fundraising offers a unique opportunity for organizations to engage their communities and support their causes. By understanding and adhering to the raffle laws in your Canadian province or territory, your organization can confidently navigate the legal landscape. Remember, while DoJiggy provides the tools your organization needs to facilitate your raffle, ensuring your event complies with local regulations is crucial.

Start planning your raffle with DoJiggy today and take the first step toward a successful fundraising event!