If you were around when your nonprofit got its start, you probably remember the times when accounting was fairly simple and straightforward. There were fewer projects, donations were probably smaller, and recording everything in a spreadsheet was perfectly reasonable.

However, as your organization grew, things got more and more complicated. This also means that your accounting tasks became more complex. The task of recording and making financial decisions for the organization may not fall neatly into the job description of your executive director anymore. That means it’s time to start looking for a nonprofit finance team.

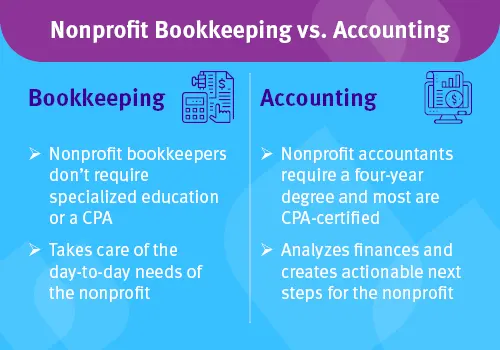

First, it’s important to know what exactly you’re looking for. Many organizations lump nonprofit bookkeeping and accounting into the same bucket, but they’re entirely different jobs! Jitasa’s guide on bookkeepers vs. accountants provides the following distinctions:

If you’ve determined that you need a nonprofit accountant, then it’s time to start analyzing your choices. We’ll dive into some of the choices you’ll need to make when considering how to handle your nonprofit accounting activities. Then, we’ll discuss the qualities that make an effective choice in accountants. Let’s get started.

Outsourcing Accounting vs. In-Kind Donation vs. Internal Hiring

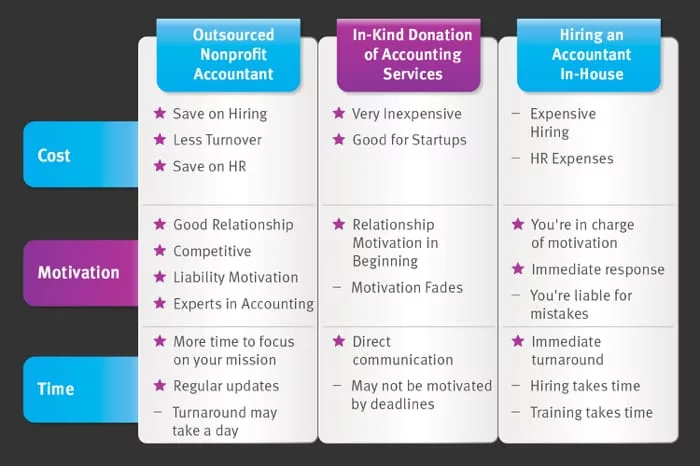

There are several ways your organization can gain access to accounting services. The first is to outsource the responsibilities to an accounting firm, the second is to accept in-kind donations of accounting services, and the third is to hire an accountant in-house.

Every nonprofit has different needs that could dictate which service or access to accounting is best for your particular needs. Here’s a general breakdown of some pros and cons for each:

- Outsourced accounting. Outsourced accounting is an option not taken advantage of enough in the nonprofit world. Instead of spending money on hiring, training, and paying a new salary, you can work with a firm of experienced accounting professionals. While these experts may not have experience with your mission in particular, they’ll be able to answer the most common questions that come up with nonprofits in general. However, turnaround time may take a little longer than an in-house professional.

- In-kind accounting service donations. Some nonprofits are fortunate to have a dedicated supporter who is also an accountant. That supporter may choose to provide accounting services in kind to the organization. This is by far the least expensive option, making it a great option for startup nonprofits. However, because they’re volunteering time, the accountant may lose motivation over the years.

- Hiring an in-house accountant. In-house accountants gain experience with your mission and have the fastest turnaround time. However, they’re also the most expensive option. Hiring takes time and costs money. They also don’t have a team to fall back on like an outsourced firm would. This option tends to be the best for very large organizations.

Often, one of the major drivers for organizations choosing between these options is their budget. It’s clear that in-kind donations are the least expensive, outsourced accounting provides the most financial flexibility, and hiring in-house is the most expensive. Consider the other pros and cons of each option before you begin looking for your new accountant. What level of need does your organization really have?

Tasks for a Nonprofit Accountant

In addition to knowing the type of service you’re looking for when looking for an accountant, know what the duties of an accountant are and what the person/firm will be responsible for completing at your organization.

When it comes to working with a nonprofit accountant, here’s what their duties generally entail:

- Reviewing accounts. Your accountant will review your various accounts and make sure everything looks correct and is on track to help your organization reach your goals.

- Balancing both sides of a transaction. In double-entry accounting systems, nonprofit accountants will review and balance both the credit and debit sides of the transaction.

- Reconciling bank accounts. An accountant will double-check to make sure all transactions on your ledger were also processed through your bank account and show up in the bank statement and vice versa.

- Preparing for audits. Audits may be required based on the federal and state or grant funding your organization receives. An accountant will help gather all of the necessary paperwork and prepare for the audit.

- Preparing your Form 990. Your nonprofit accountant will help prepare your Form 990 to report your organization’s annual earnings back to the IRS.

- Reviewing accounts for GAAP standards. Generally accepted accounting principles (GAAP) standards are set to help organizations maintain transparency and consistency in finances.

- Comparing projected and actual revenue and expenses. By reviewing your budgeted expenses and revenue, your nonprofit will be able to understand differences over certain periods of time.

Consider your nonprofit’s financial needs. Do they line up with the general responsibilities of an accountant? Or, is there another need you’re trying to fill? This will set your expectations and ensure you’re hiring for the right role at your nonprofit.

3 Features to Look For in an Accountant

Whether you’re looking for an accountant to hire in-house, an in-kind service provider, or an accounting firm with numerous experts, there are several qualities that nonprofit organizations should specifically look for in the hiring process. This includes nonprofit-specific experience, experience with fund accounting software, and a passion for helping others.

Nonprofit-Specific Experience

One might think that accounting is accounting, however, there are several differences between accounting for various organizations. You wouldn’t balance your personal budget the same way you approach one for a small business. Accounting for nonprofits is also known as fund accounting, which takes into consideration the nonprofit-specific aspects of finances. For example, consider the following:

- Grant management. Most for-profit organizations don’t rely on grant funding to run their organizations. However, the majority of nonprofits apply for several grants and rely on them annually. Every grant has different reporting requirements, restrictions on funding, and deadlines to hit. Therefore, an accountant needs to be organized to react to the various requirements set by granting organizations.

- Fundraising restrictions. Some individuals and grant funders provide funds to nonprofits in the condition that the organization only uses those funds for certain projects. Restricted revenue is often provided in large amounts, making it a great fundraising opportunity, but it does mean you need to carefully consider your budget to account for these restrictions.

- Taxes. Registered nonprofits don’t pay federal income taxes and most states also provide tax breaks to 501(c)(3) organizations. However, you do need to report revenue to the IRS so they can make sure you’re using these funds responsibly.

Because accounting for nonprofits is so different from accounting for for-profits, it’s best to look for an accountant or an accounting firm with experience in the nonprofit sector. One that specializes in nonprofit accounting is even better!

Experience with Fund Accounting Software

Just as nonprofit accounting is different from for-profit accounting, the software also differs between the two. Fund accounting software allows your organization to account for the restrictions and other nonprofit-specific accounting systems.

There are several types of accounting software that your organization may choose to use. However, the most popular solution for organizations is QuickBooks.

Look for an accountant with experience working with fund accounting software. The best option? Look for an accounting firm that will provide you with access to fund accounting software so you don’t have to purchase it independently.

Passion for Helping Others

Nonprofits focus on helping others in their communities, whether that’s by providing education, food, shelter, medical supplies, or other resources. This is what keeps them motivated to continue working toward the mission and it’s what establishes the nonprofit’s brand in the community.

Look for a nonprofit accountant with a passion for helping others to encourage that same type of motivation. If they’re driven to help others, they’ll be more motivated to help your organization succeed in your mission as well!

If your organization is growing, you might be rethinking your approach to accounting. Carefully consider what your needs are and if you need to ask for an in-kind donation, outsource your accounting, or hire an in-person accountant. Then, make sure to hire the right person with the right experience and motivation to help you succeed. Good luck!

Guest Author – Jon Osterburg has spent the last nine years helping more than 100 nonprofits around the world with their finances as a leader at Jitasa, an accounting firm that offers bookkeeping and accounting services to not-for-profit organizations.